Home / Money Market Savings Account Current Rate up to 0.50% APY. This higher dividend-earning account is an ideal alternative to certificates, allowing you to earn a great rate of return plus your money is available to you at any time.

- Which Online Money Market Savings Accounts Earn Compound Interest Calculator

- Which Online Money Market Savings Accounts Earn Compound Interest On Your Money

- Which Online Money Market Savings Accounts Earn Compound Interest Rates

- Which Online Money Market Savings Accounts Earn Compound Interest Rate

Which Online Money Market Savings Accounts Earn Compound Interest Calculator

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

One of the best parts of opening a savings account is watching the money you deposit grow over time, thanks to interest.

Savings accounts typically grow with compound interest — thatmeans you earn interest both on the amount you’ve saved and any interest youpreviously accrued.

Let’s a take a look at how compound interest works and factors that can affect how quickly your money grows.

What is compound interest on a savings account?

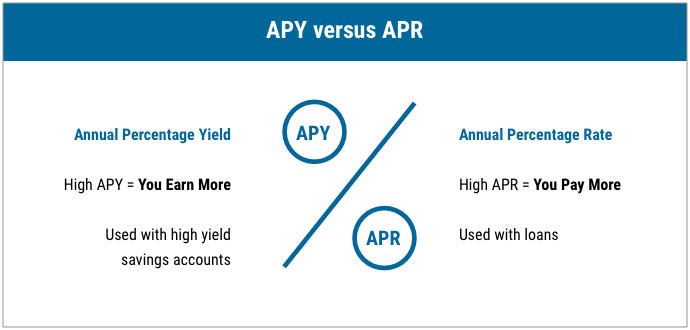

You may have heard of interest on a credit card or car loan —that’s the cost of borrowing money from a bank or lender — and it’s expressedas a rate.

On the flipside, when financial institutions borrow moneyfrom you, they pay you interest. They typically pay interest on depositaccounts — such as savings accounts, checking accounts and money marketaccounts — in exchange for the ability to use your money until you need it.

Savings accounts can earn interest one of two ways: through simpleinterest or compound interest. With simple interest, you earn interest onlyon your principal — the amount you’ve deposited into your account.

But compound interest allows you to earn interest on yourprincipal and the interest you’ve already earned.

Let’s say your bank compounds interest on your account everymonth. After the first month, the bank pays interest on the principal. The nextmonth, the bank pays interest on the principal plus the previous interest youearned. From there, the interest continues to accumulate each month on thecombined amount of your savings and interest earned.

In general, you’ll earn more on an account with compoundinterest than on one with simple interest.

How often does a savings account compound interest?

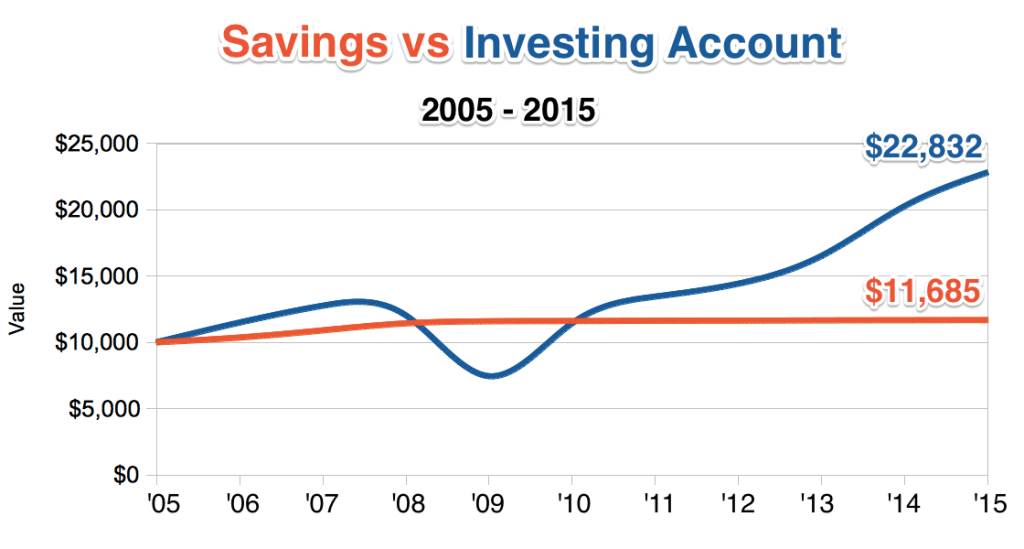

Depending on your financial institution and the account,interest can compound daily, monthly, quarterly or annually. The more ofteninterest compounds, the faster your balance will grow.

The amount of interest you earn each year, based on the total amount of interest earned and how often interest is compounded, is expressed as the annual percentage yield, or APY. The more frequently interest is compounded, the higher your APY — and therefore, your interest earnings — will be.

How do you calculate compound interest?

Which Online Money Market Savings Accounts Earn Compound Interest On Your Money

An online compound interest calculator can help you crunch the numbers, but you can also do the math yourself. Here’s the equation for calculating compound interest.

Here’s an example to help you figure out the future value of your savings account.

Let’s say you open an account with an initial deposit of $2,000 (this is your principal, or P). If your annual interest rate is 2%, then R = 0.02. If your bank compounds interest once a month, N =12 here. Let’s say you want to calculate how much you’d have in savings after two years (T = 2).

Your calculation would look like this.

A = 2,000(1+ 0.02/12)(12 x2)

At the end of two years — assuming you haven’t withdrawn or made any deposits to the account — you’d have $2,081.55. Your original deposit was $2,000, so you would’ve earned $81.55 in interest.

Factors that affect how much interest you earn

A range of factors can influence how much interest you can earn— and how quickly you earn it. Here are a few.

The amount of money in your account

Generally, the more money you have in your savings account,the more interest you’ll earn over time. Making recurring deposits means you’llearn interest on a larger balance, while withdrawing money means you’ll accrueinterest on a smaller balance. In other words, it pays to keep the money inyour account.

Your interest rate

Which Online Money Market Savings Accounts Earn Compound Interest Rates

Your APY may change over time, especially if the Federal Reserve raises or lowers the federal funds rate, so be sure to pay attention to any rate changes.

How frequently your financial institution compounds interestwill affect how much you earn, too — another reason why comparing APYs acrosssavings accounts is important.

Account fees

While account fees won’t change the amount of interest you earn, they could offset your earnings — or, worse yet, you could end up paying more in fees than you earn in interest. Depending on the institution and the account, you might pay a monthly maintenance fee or fees for exceeding your withdrawal limit, requiring overdraft protection or using an ATM, among others. Banks usually offer workarounds to avoid some monthly fees, such as keeping a minimum balance, so read all the terms before opening an account.

What’s next?

Whether you’re saving for a car down payment, building anemergency fund or working toward another savings goal, a savings account withcompound interest could be a good place to stash your money. The interest worksin your favor, and you can access the funds in a pinch.

To help find the best savings account for your financial goals, shop around and compare APYs and terms from a range of institutions. Keep in mind that some online banks may offer higher rates than brick-and-mortar banks or credit unions.

You might also consider a high-yield savings account, which offers a higher interest rate than traditional savings accounts. Just make sure the bank, credit union or other depository institution is insured by the FDIC or NCUA, and pay attention to the fine print, such as minimum deposit or balance requirements, how often the interest compounds, and any fees — details that can affect your rate of return in the long run.