Governments in most developed countries typically finance a budget deficit (the gap between government spending and tax receipts) through borrowing from the domestic or foreign private sector. Occasionally, if they can’t raise enough revenue through selling bonds to the private sector, they can get the central bank to print money to buy the bonds. This is debt monetization. This is quite rare in developed countries but it is more likely in developing countries where there can be crises (eg wars) that lead to a collapse in the ability to collect taxes, so deficits can rise beyond the government’s ability to raise revenue through borrowing. It can also happen when lenders fear sovereign default, and begin to demand ates of interest on government borrowing that the government cannot afford.

The revenue gained by government by printing money is called seignorage. It is effectively a tax on real money balances.

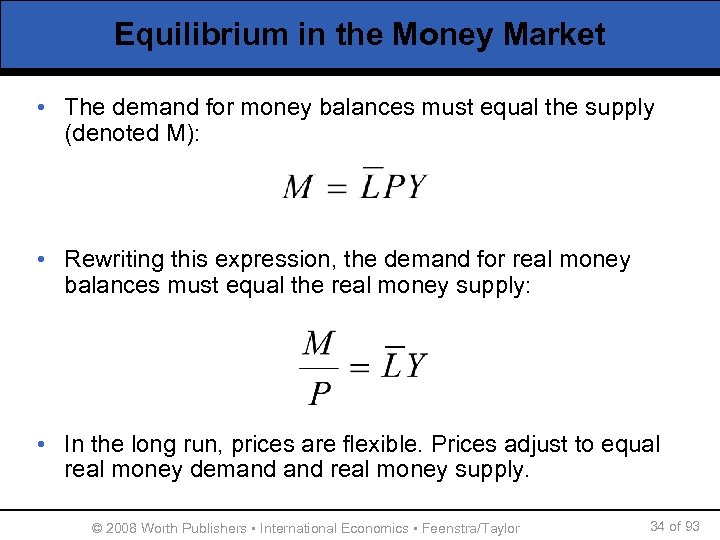

The real-balance effect works like this: A higher price level decreases the purchasing power of money resulting in a decrease in consumption expenditures, investment expenditures, government purchases, and net exports. A lower price level has the opposite affect, causing an increase in the purchasing power of money which results in an increase. Real Balance Effect: The term ‘real balance effect’ was coined by Patinkin to denote the influence of changes in the real stock of money on consumption expenditure, that is, a change in consumption expenditure as a result of changes in the real value of the stock of money in circulation. This influence was taken into consideration by Pigou. Demand for money Real moneyis the quantity of money measured in constant dollars. YReal money is equal to nominal money divided by price level. Real money measure what it will buy. YIn the above example, real money = $22/1.1 = $20. The quantity of real money demanded is independent of the price level. Demand for money The Interest Rate.

The seignorage revenue received by the government is . We can multiply the expression by just to give us an alternative way of writing it.

, in other words it is the rate of money growth multiplied by real money balances.

Inflation approximately equals nominal money growth minus output growth , so in the short run where there is no output growth, growth .

So we can write the expression for seignorage as being , ie it is inflation multiplied by the amount of real money balances in the economy (hence it being a tax on real money balances).

This is pretty effective tax because you can’t avoid it. Anybody who holds money effectively pays the tax because their money becomes worth a little bit less but the government is getting free money to spend on its spending programmes.

There is a complicating factor here, because the demand for money declines as inflation rises. You can express money demand in the form , ie the demand for real money balances is a function of income (or output), and peoples liquidity preference schedule (how downward sloping the money demand curve is). Note that it is a function that is increasing in terms of income (the richer people are the more money they want to hold) and declining in terms of nominal interest rate (when interest rates are higher, people want to hold less money and more bonds or other forms of illiquid assets).

You can write this in terms of real interest rates as .

Over time, income, the real interest rate, and expected inflation can all change. But it is useful to think of what would happen in the ‘super short run’ (like month by month timescales) when modelling seignorage, because the big risk with seignorage (as will be explained soon) is that it triggers very high inflation, where inflation changes very quickly over a time scale where the real interest rate and income are more or less static.

So to model this we will assume that income and real interest rate stay constant and the variable factor is expected inflation: , where L (demand for money) and hence seignorage, is declining in .

This implies during times of high inflation, money demand depends mainly on expected inflation. As expected inflation rises, money demand falls. This is basically because as money is losing its value quickly, you don’t want to hold it for very long – higher expected inflation increases the opportunity cost of holding money.

However, in practice the real interest rate may become very negative because the nominal interest rate does not keep up with inflation, so you are not always better off holding bonds either! And it is hard to put your money in bonds fast enough, it may not be practical. So instead people start bartering goods, they start demanding wages more often (eg twice a week), or they start using a hard currency (eg dollarization). As inflation rises rapidly, people do whatever they can to avoid holding cash, and demand for money collapses.

Think about what is going on here. On the one hand, increasing money growth, is increasing the rate of the inflation tax (so seignorage is rising), on the other hand, increasing money growth is increasing inflation and decreasing money demand and so the amount of real money balances being held in the economy (so seignorage is falling). There are two effects working against each other here.

We have two equations: and .

We can combine them to get: , where L (demand for money) and hence seignorage, is declining in .

Now think about what would happen if we had constant money growth. Over time, inflationary expectations would adjust to the constant level of money growth, they would catch up with it, so . Here is entering the equation twice. Inflation is increasing in it directly and declining in it indirectly via inflationary expectations and falling money demand. At the start the indirect effect is small but it becomes large quite quickly, eventually outweighing the direct effect. There is therefore a hump shape like a Laffer curve, in terms of the amount of ‘tax’ (seignorage) that can be collected in this way. There will be a rate of constant money growth which optimises the amount of seignorage revenue.

Example: suppose the economy has GDP of 100. The real money stock is given by the money demand equation where and so .

To find the rate of constant nominal money growth that would maximise seignorage we start with the equation remembering that in the case of constant nominal money growth, .

So .

So to optimise this we differentiate and set equal to zero so .

What Are Real Money Balances

This tells us that the optimising rate of nominal money growth is 48.5%. With this level of money growth we could raise seignorage revenue of ie we can raise maximum income of 23.523 through seignorage. Given that GDP is 100, this means the maximum budget deficit we could cover through seignorage would be 23.523% through seignorage.

Define Balance Economics

Now what would happen if the budget deficit was actually 28%, ie we needed to raise income of 28 through seignorage. We can’t do this keeping constant money growth, the only way we could do this is to hike up nominal money growth above the level of expected inflation. We can get away with this in the short run, but inflationary expectations will catch back up with our new level of expected inflation.

Remember that in our short run with no growth, , so when we have money growth of 48.5%, we already have inflation of 48.5% (not a good situation to be in). So inflationary expectations will be 48.5%.

What rate of nominal money growth could get us seignorage revenue of 28 with inflationary expectations of 48.5%?

. So we need money growth of 57.73% which means inflation of 57.73%. In the short run we can get the required level of seignorage with this higher level of inflation, but what happens when inflationary expectations catch back up to the new level of money growth? We will have to do the equation again, with 57.73% as the new value for expected inflation. This will imply that we need an even higher rate of money growth, and hence inflation, to hit our seignorage target.

The moral of the story here is that there is an optimal rate of seignorage revenue that you can generate (depending on the parameters of the money demand equation) through constant money growth.

Economic Balance Definition

If you want/need to raise seignorage revenue higher than that, you have to do it through increasing money growth. This means you are going to trigger an inflationary spiral, and this is how you end up with hyperinflation.